Forex Trading: Is Forex Trading Legal in India? Risks & Opportunities

Briefly Explain with (Is Forex Trading Legal in India) Forex trading is often underrated in India. However, with the right strategy and legal approach, it can offer significant returns. This article explains how to invest in forex trading, its risks, opportunities, and valuable tips.

What is Forex Trading?

Forex trading, also called foreign exchange or currency trading, is a decentralized global market where currencies are bought and sold. It is the largest financial market in the world. Similar to stocks, you can trade currencies based on your expectations of their value or future movement.

Forex trading allows you to buy one currency while selling another simultaneously. It is legal to trade forex on Indian exchanges like BSE, NSE, and MCX-SX. However, forex trading involves high risks, where fortunes can be made or lost in a very short time.

The forex market provides flexibility, making it easier to find a buyer or seller compared to other markets.

Is Forex Trading Legal in India ?

Forex trading platforms are banned in India, but trading through stock exchanges is allowed. The Foreign Exchange Management Act (FEMA) makes binary trading illegal. Although dealing in foreign currencies is legal, strict regulations apply.

In India, the Indian Rupee (INR) must be used as the base currency. The permitted currency pairs include:

- USD/INR (US Dollar)

- EUR/INR (Euro)

- GBP/INR (Great Britain Pound)

- JPY/INR (Japanese Yen)

How Is Forex Trading Legal in India

To trade forex legally in India, you must follow these steps:

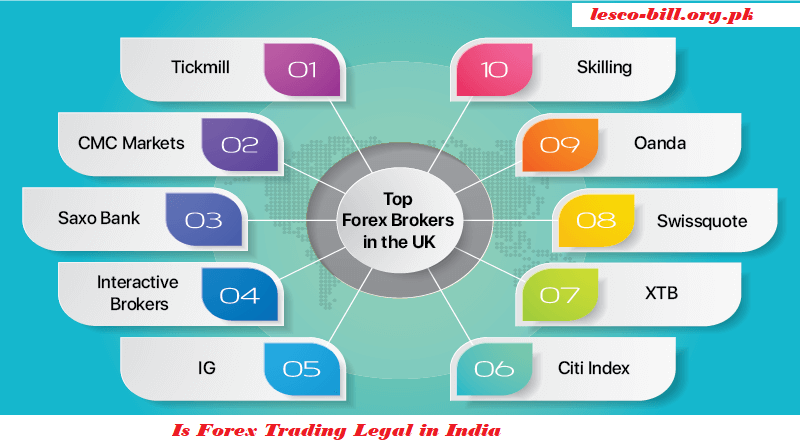

- Choose a broker with global reach, as the forex market operates in cities like New York, London, Tokyo, and Singapore.

- Use strategies that comply with Indian regulations.

Common Forex Trading Strategies

Forex trading requires careful planning due to its high liquidity and risks. Here are some widely used strategies:

1. Price Action Technique

This is one of the most popular strategies. It relies on analyzing price movements influenced by market forces like supply and demand.

2. Trend Trading

Traders identify the currency’s price trend (up or down) and determine entry points using tools like moving averages and relative strength indicators.

3. Counter Trend Trading

In this approach, trades are placed against the current trend, aiming to make small profits when the trend reverses.

4. Range Trading

This strategy involves trading within a specific price range. Traders analyze currency demand and supply to identify favorable price conditions.

5. Breakout Trading

Here, traders enter the market as the price breaks out of a previous trading range.

6. Position Trading

Experienced traders use this strategy, focusing on long-term trends by analyzing charts at the end of each day.

7. Carry Trade

This strategy involves selling a low-interest-rate currency and buying a high-interest-rate currency to benefit from the interest rate difference.

8. Set Your Limits

It is important to define your boundaries, such as when to exit a trade or stop trading. This helps make informed decisions in the future.

Foreign Exchange Risks

Forex trading comes with risks, especially when financial transactions involve multiple currencies. Here are some common risks:

1. Transaction Risk

This occurs when the exchange rate changes between the time a transaction is initiated and settled. Tools like forward contracts and swaps can reduce this risk.

2. Economic Risk

Also known as forecast risk, this arises when exchange rate changes affect a company’s market value. Factors like geopolitical instability or government policies often cause economic risk.

3. Translation Risk

This happens when a company operates in one country but reports its financials in another currency. Translation risk increases if a large portion of assets or liabilities is held in foreign currencies.

Conclusion

Forex markets are the most liquid financial markets in the world, with trillions of dollars traded daily. Whether trading in spot, futures, or options markets, forex offers opportunities for both speculators and hedgers. With proper strategies, forex can be a powerful tool to manage currency fluctuations and achieve financial goals.

FAQs on Forex Trading Legal in India

1. Is Forex trading legal in India?

Yes, forex trading is legal in India but with restrictions. It can only be done through Indian exchanges like BSE, NSE, and MCX-SX. Trading in currency pairs is limited to those involving the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR.

2. Can I trade foreign currencies directly through international brokers?

No, trading through foreign forex platforms is prohibited under the Foreign Exchange Management Act (FEMA). Only authorized Indian exchanges and brokers can facilitate legal forex trading in India.

3. What are the main risks involved in forex trading?

Forex trading carries risks such as:

- Transaction Risk: Exchange rate fluctuations between transaction initiation and settlement.

- Economic Risk: Impact of macroeconomic changes on currency values.

- Translation Risk: Losses due to foreign currency holdings when converted to a local currency.

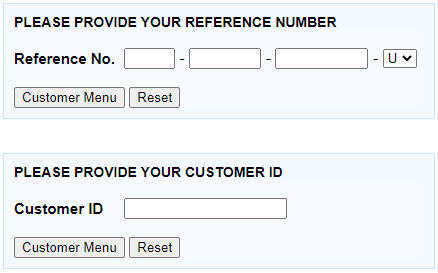

4. How can I start forex trading legally in India?

To start forex trading legally in India, you need to:

- Open an account with a broker authorized by SEBI (Securities and Exchange Board of India).

- Trade in currency pairs allowed by Indian regulations.

5. What strategies are best for beginners in forex trading?

For beginners, strategies like Price Action Trading and Trend Trading are recommended. These involve analyzing currency movements and identifying favorable entry and exit points based on trends.

6. What is the minimum amount required to trade forex in India?

The minimum amount varies by broker and the currency pair being traded. Many brokers allow trades with a small initial margin, making forex trading accessible to individuals with limited capital.